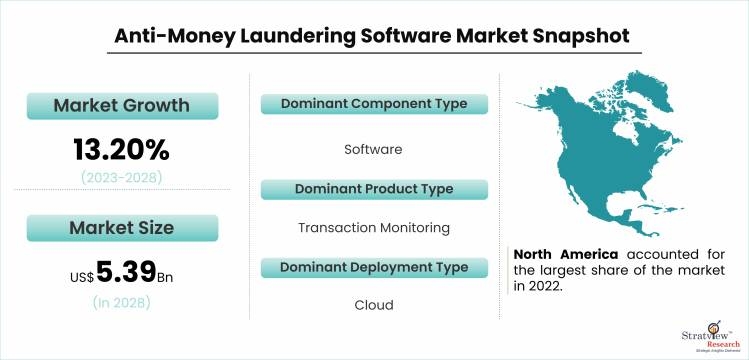

The Anti-Money Laundering (AML) software market has witnessed significant growth and transformation in recent years, driven by evolving regulatory landscapes, increasing financial crimes, and advancements in technology. The anti-money laundering software market is estimated to grow from USD 2.55 billion in 2022 to USD 5.39 billion by 2028 at a CAGR of 13.20% during the forecast period.

As we look at the emerging trends in the AML software market, it becomes evident that the industry is undergoing a rapid evolution to stay ahead of money launderers and terrorist financiers.

Artificial Intelligence and Machine Learning: One of the most prominent trends in AML software is the integration of artificial intelligence (AI) and machine learning (ML) algorithms. These technologies enable AML solutions to analyze vast amounts of data in real-time, detecting suspicious patterns and anomalies that would be impossible for humans to identify. AI-driven AML software not only improves accuracy but also reduces false positives, making compliance processes more efficient.

Advanced Analytics: AML software is increasingly incorporating advanced analytics tools. This allows financial institutions to gain deeper insights into customer behavior, transaction patterns, and risk factors. Predictive analytics can help institutions proactively identify potential money laundering activities and take preventive measures.

Blockchain and Cryptocurrency Monitoring: With the rise of cryptocurrencies, AML software is now extending its capabilities to monitor blockchain transactions. These technologies help in tracking and analyzing cryptocurrency transactions to ensure compliance with AML regulations. As cryptocurrencies gain mainstream adoption, this trend is expected to become more critical.

Regulatory Technology (RegTech): The regulatory landscape is constantly evolving, with stricter AML regulations being enforced worldwide. RegTech solutions within AML software are designed to streamline compliance processes by automating the reporting and documentation required to meet these regulations. This not only reduces the compliance burden but also minimizes the risk of non-compliance fines.

Cloud-Based Solutions: Cloud-based AML software solutions are becoming more popular due to their scalability and cost-effectiveness. Financial institutions can easily scale their AML systems according to their needs, reducing the need for heavy on-premises infrastructure.

Collaborative Platforms: AML software is increasingly emphasizing collaboration between financial institutions and regulatory authorities. Sharing of AML data and insights helps in creating a more comprehensive and effective AML ecosystem. This collaborative approach enables quicker identification of money laundering schemes that span multiple institutions.

Customer Due Diligence (CDD) Automation: Automating customer due diligence processes is a crucial trend in AML software. Enhanced CDD capabilities allow financial institutions to efficiently verify customer identities, screen against sanctions lists, and assess customer risk profiles.

Geographic Expansion: As money laundering activities become more globalized, AML software is expanding its capabilities to cover a broader range of regions and jurisdictions. This includes the ability to adapt to different languages, currencies, and regulatory frameworks.

User-Friendly Interfaces: AML software is becoming more user-friendly, with intuitive interfaces and dashboards that make it easier for compliance professionals to navigate complex data and reports.

In conclusion, the AML software market is evolving rapidly to meet the challenges posed by increasingly sophisticated financial crimes and a constantly changing regulatory landscape. The integration of AI, advanced analytics, and blockchain monitoring are reshaping the industry, making compliance processes more effective and efficient. Cloud-based solutions, RegTech, and collaboration between institutions and regulators are also key drivers of change. As AML software continues to advance, financial institutions will be better equipped to combat money laundering and protect the integrity of the global financial system.