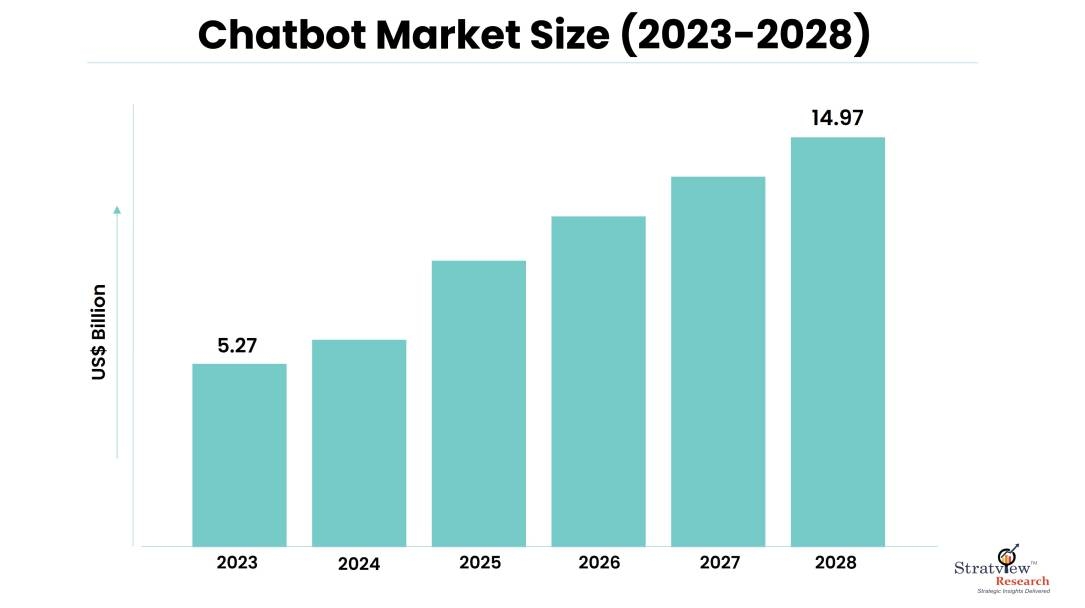

In the rapidly evolving landscape of financial services, technology has played a pivotal role in reshaping how businesses interact with customers. Among the many technological innovations, chatbots have emerged as a game-changer, transforming customer engagement and operational efficiency for financial institutions. These virtual assistants are more than just a trendy addition; they are a crucial tool in modernizing the industry. According to this report by Stratview Research, the global chatbot market is estimated to grow from USD 5.27 billion in 2023 and is likely to grow at a CAGR of 23.28% during 2023-2028 to reach USD 14.95 billion by 2028.

Enhanced Customer Engagement

Chatbots have revolutionized customer engagement in financial services. They offer instant, 24/7 support, ensuring that customers can access assistance whenever they need it. This responsiveness is crucial, especially in a sector where time is of the essence, and customers expect quick resolutions to their queries.

Additionally, chatbots provide a personalized experience by analyzing customer data and transaction history. This enables them to offer tailored financial advice, suggest relevant products, and even assist with investment decisions. Such personalized interactions not only enhance customer satisfaction but also strengthen brand loyalty.

Efficiency and Cost Reduction

Operational efficiency is paramount in financial services. Chatbots excel in automating routine tasks, such as balance inquiries, fund transfers, and account management. This not only frees up human agents to focus on more complex tasks but also reduces the chances of errors.

Furthermore, chatbots handle a large volume of customer inquiries simultaneously, a feat impossible for human agents. This scalability allows financial institutions to serve more customers efficiently without the need to hire and train additional staff. As a result, cost savings can be significant.

Risk Mitigation and Compliance

Compliance with financial regulations is non-negotiable. Chatbots in financial services can be programmed to adhere strictly to these rules, reducing the risk of compliance breaches. They can also maintain meticulous records of interactions, which can be crucial in audits and investigations.

Moreover, chatbots can identify and report suspicious activities more effectively than humans due to their ability to analyze vast amounts of data in real-time. This enhances fraud detection and prevention, safeguarding both the financial institution and its customers.

Continuous Improvement

Chatbots are not static entities; they continuously evolve and improve through machine learning and artificial intelligence. As they interact with more customers, they become better at understanding and addressing complex queries. This self-learning capability ensures that the quality of customer service keeps improving over time.

Human-Agent Synergy

Chatbots are not here to replace human agents; they are here to complement them. When a query surpasses the chatbot's capabilities or requires a human touch, seamless handovers to human agents can occur. This ensures that customers receive the best of both worlds – the efficiency of automation and the empathy of human support.

In conclusion, chatbots have brought about a paradigm shift in the financial services industry. They have revolutionized customer engagement, enhanced operational efficiency, mitigated risks, and improved compliance. The financial institutions that embrace this technology are poised to thrive in an increasingly competitive landscape. However, it's important to strike a balance between automation and human interaction to ensure that customer service remains both efficient and empathetic. As chatbot technology continues to advance, its potential to transform financial services for the better is limitless, promising a brighter, more responsive, and efficient future for the industry and its customers.