If you're considering investing in real estate in Belize, it's important to understand the tax implications. While taxes may not be the most exciting topic, they can have a significant impact on your financial obligations as a property owner. Fortunately, with some basic knowledge and planning, managing your taxes doesn't have to be overwhelming or stressful. In this blog post, we'll explore some of the key tax considerations for owning real estate in Belize and how they compare to other countries. We'll also discuss the benefits of investing in Belizean property and any potential challenges you should be aware of before making a purchase. So grab a cup of coffee (or tropical fruit juice!) and let's dive into the world of Belize Real Estate taxes!

What are the real estate tax considerations in Belize?

Belize is known for its stunning beaches, lush rainforests, and diverse culture. It's not surprising that many people are drawn to investing in real estate here. However, before you make a purchase, it's important to understand the tax implications.

One of the primary taxes associated with owning real estate in Belize is property tax. This tax is assessed annually based on the value of your property and is payable to the local government. The rate varies depending on location but typically falls between 1-2% of the property value.

In addition to property tax, there may be other taxes associated with purchasing or selling real estate in Belize. For example, if you sell your property within five years of purchase, you may be subject to a capital gains tax on any profit made from the sale.

It's also worth noting that non-residents who own property in Belize are required by law to file an annual income tax return reporting all income earned in Belize (including rental income).

While navigating these taxes can seem daunting at first glance, it's important to work with experienced professionals such as attorneys and accountants who can help ensure compliance with all relevant laws and regulations.

How do they compare to other countries?

When it comes to real estate tax considerations, Belize is often seen as a favorable option compared to other countries. For example, in the United States, property taxes can vary greatly depending on the state and even the county that you live in. In some cases, property taxes can be quite high and may increase significantly over time.

In contrast, Belize has a relatively low property tax rate of just 1-1.5% of the assessed value of your property. This means that owning real estate in Belize can be an affordable way to invest in your future without breaking the bank.

Another factor to consider is capital gains taxes. In many countries, including the United States, if you sell a piece of real estate for more than you paid for it (a capital gain), you will typically owe taxes on that profit. However, Belize does not currently have any capital gains tax or inheritance tax laws in place.

When comparing real estate tax considerations between different countries around the world, Belize stands out as being relatively affordable and investor-friendly. That's why so many people are choosing to invest their money into this beautiful country and its thriving real estate market!

What are the benefits of owning property in Belize?

Owning property in Belize can be a dream come true for many individuals. The country offers breathtaking scenery, warm weather year-round, and a laid-back lifestyle that is perfect for those looking to escape the hustle and bustle of city life.

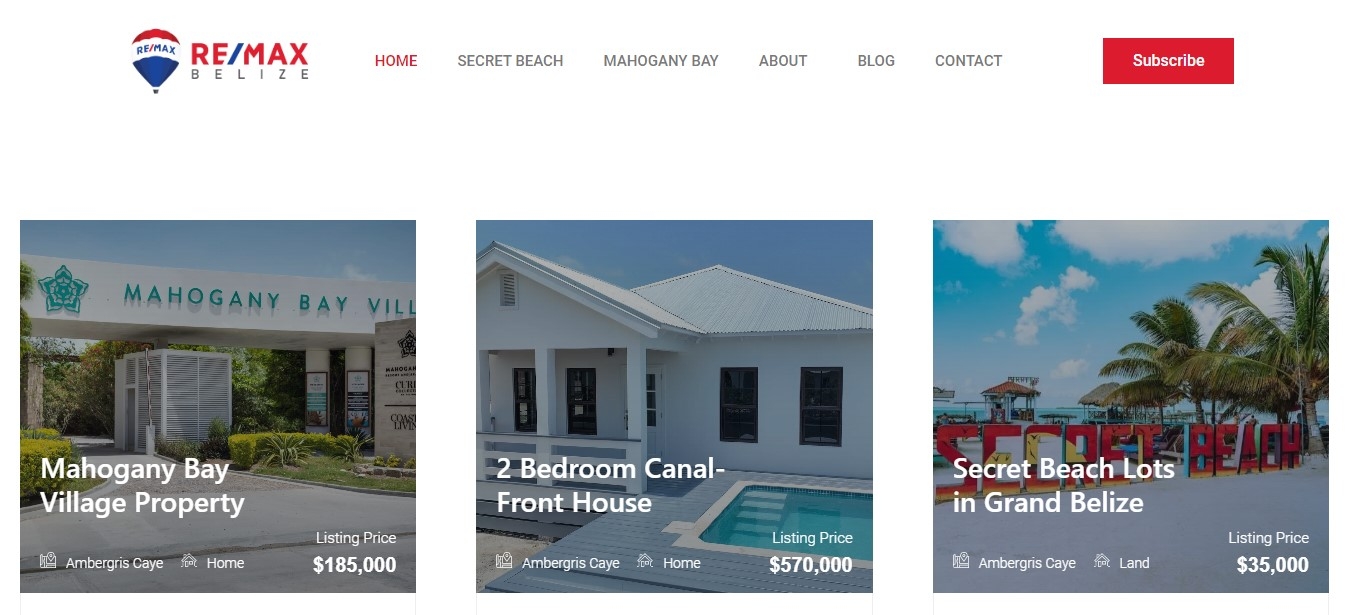

One major benefit of owning property in Belize is the affordability compared to other countries. Properties in prime locations such as Ambergris Caye or Placencia are still reasonably priced when compared to similar areas in neighboring countries like Mexico or Costa Rica.

Additionally, there are no capital gains taxes in Belize which means if you decide to sell your property down the line, you won't have to pay any additional taxes on top of what you've already paid.

Another advantage of owning property in Belize is the ease of acquiring residency. If you own real estate with a minimum value of $25,000 USD, you can apply for residency and enjoy all the benefits that come with it including tax incentives and exemption from import duties on household goods.

Owning property in Belize provides numerous benefits that make it an attractive option for both investment purposes and personal use alike.

Are there any challenges to be aware of?

While owning property in Belize can be a great investment, there are definitely some challenges to consider. One of the biggest things to keep in mind is that the real estate market in Belize is relatively unregulated. This means that you'll need to do your own due diligence when it comes to purchasing property and ensuring that all legal requirements are met.

Another challenge for many people is managing their financial obligations related to owning property in Belize. While taxes are generally lower than they would be in other countries, there may still be fees and expenses associated with maintaining your property or paying for utilities.

Additionally, it's important to consider the potential risks associated with natural disasters such as hurricanes and flooding. While these risks can't necessarily be avoided entirely, taking steps like investing in insurance or building on higher ground can help mitigate them.

While there may be some challenges associated with owning property in Belize, these shouldn't deter you from considering this beautiful country as a potential investment opportunity. By doing your research and working with experienced professionals throughout the process, you can ensure that you're making informed decisions every step of the way.

Conclusion

Owning real estate in Belize can be a great investment opportunity for both locals and foreigners. The country's tax laws are designed to encourage property ownership, which means that taxes on your investments will generally be lower than what you might encounter elsewhere.

However, it's essential to understand the obligations of owning real estate in Belize before investing. This includes knowing about the various taxes involved with owning property and understanding how they compare to other countries.

When it comes to managing financial obligations related to Belizean real estate, doing your research is key. Working with a local attorney or accountant who understands the intricacies of these regulations can help ensure that you aren't caught off guard by any unexpected expenses down the line.

As long as you're aware of all potential costs associated with buying and maintaining property in Belize, there's no reason why this beautiful Central American nation shouldn't become your next real estate destination!