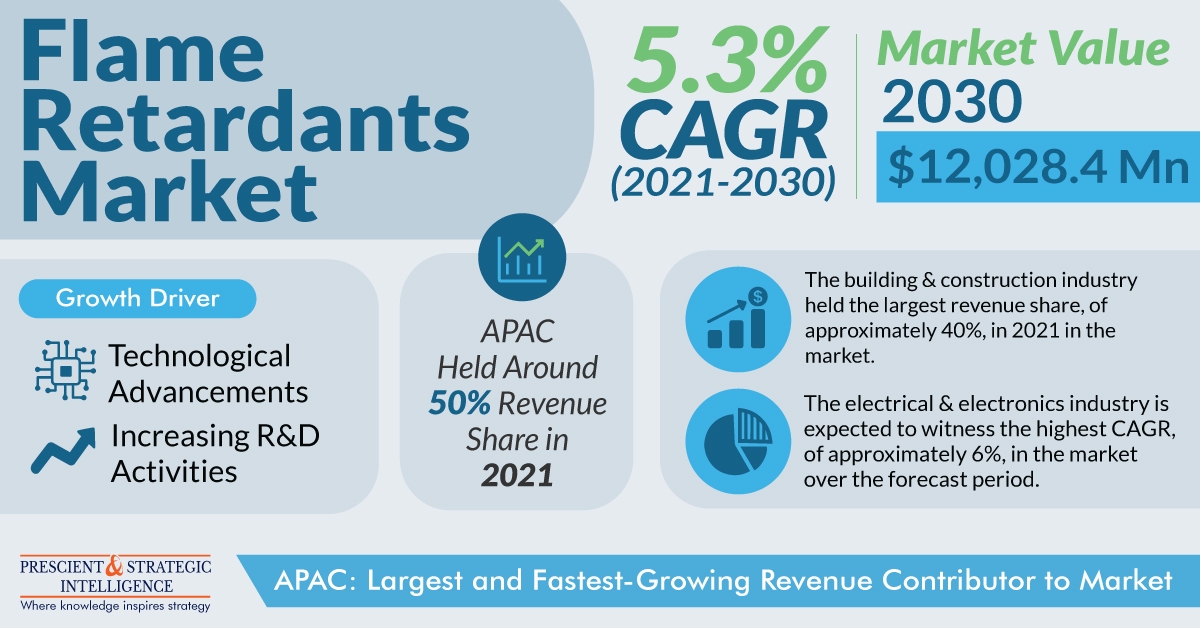

In 2021, the flame retardants market size stood at USD 7,565.1 million, which is projected to witness a 5.3% CAGR during 2021–2030, to reach USD 12,028.4 million by 2030, as per P&S Intelligence. This is credited to technological enchantments, rising end-use industries, and snowballing research and development activities. Furthermore, the growing strictness of regulations on fire safety in several countries boosts the market growth.

In 2021, non-halogenated flame retardants generated a larger revenue share and this category is projected to grow at a CAGR of over 5% in the coming few years. This is because such chemicals exhibit excellent flame retardancy, thermodynamic characteristics, and smoke suppression, which make them appropriate for anti-fire applications in many industries.

Furthermore, such chemicals are gaining traction, due to environmental initiatives taken by numerous governments to reduce the utilization of halogenated compounds, which have hostile effects on humans, such as airway obstruction, dyspnea, pneumonitis, acute respiratory distress syndrome, pneumonitis, hypoxemia, and pulmonary edema, and also surface ozone formation, which damages the air quality.

In 2021, the building and construction sector held the largest revenue share, of around 40%. The rising number of infrastructure events in developing nations, including India and China, is fuelling the demand for such chemicals.

The electrical & electronics sector is projected to experience the highest CAGR, of around 6%, in the flame retardants market in the coming years. This development can be credited to the snowballing use of plastics in the manufacturing of electronic components and the growing utilization of insulation on products, for fire risk reduction and consumer safety, which is itself a result of the solid requirement of manufacturers to obey fire safety guidelines.

In 2021, the APAC flame retardants market accounted for the largest revenue share, of approximately 50%, and it is projected to keep the leading position in the coming years as well. This is credited to the quickly expanding manufacturing industry and infrastructure growth activities in the region.

Additionally, APAC is the biggest manufacturer of electronic products throughout the world, accounting for 70–75% of the global output. Japan, China, and South Korea manufacture a wide range of electrical components and supply them to various industries globally.

Europe is the second-largest revenue generator in the market. This is because of the large transportation, textile, and automotive industries in the region. Moreover, nations like the U.K. and Germany invest an enormous amount in the construction sector, which supports the regional market growth.